Who We Are

We’re a real estate investment trust (REIT) based in Fargo, ND.

Our Mission

To provide low-risk and income-producing real estate investment opportunities to investors.

Our Vision

To be the most reliable, well-managed, and transparent REIT in the United States.

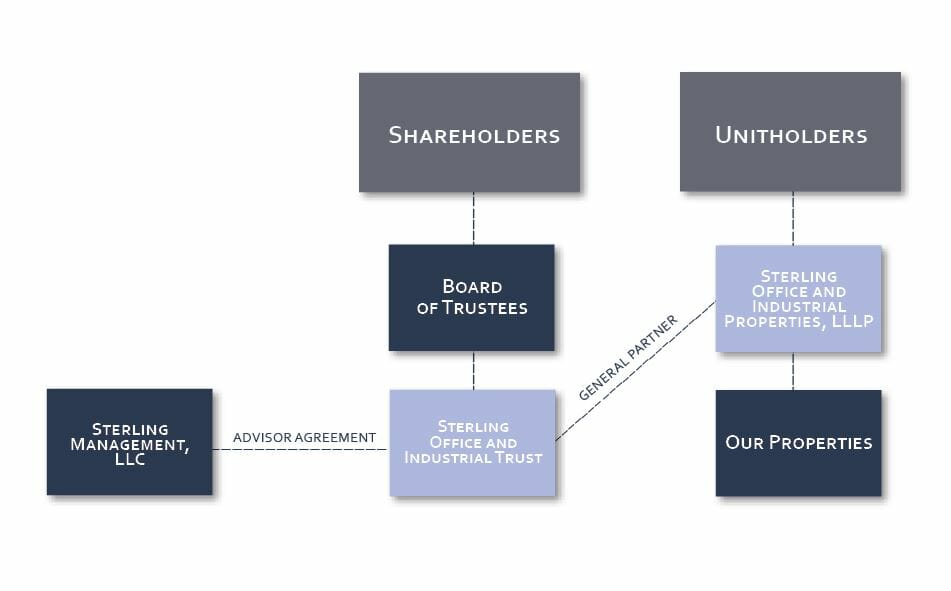

THE COMPANY STRUCTURE FOR STERLING OFFICE AND INDUSTRIAL TRUST

Sterling Office and Industrial Trust

Sterling Office and Industrial Trust is an unincorporated North Dakota trust formed on March 2, 2016, to invest primarily in a diversified portfolio of freestanding, single or multi-tenant office and industrial properties net leased to creditworthy tenants and other real estate related assets. The Trust elected to be taxed as a Real Estate Investment Trust (“REIT”) under Sections 856-860 of the Internal Revenue Code.

Sterling Office and Industrial Properties, LLLP

Sterling Office and Industrial Trust is an Umbrella Partnership Real Estate Investment Trust, and holds all of its properties in a separate partnership, Sterling Office and Industrial Properties, LLLP (“Sterling Office and Industrial Properties”). The Trust controls Sterling Office and Industrial Properties and acts as its general partner. The Trust uses Sterling Office and Industrial Properties to acquire properties, including through the exchange of limited partnership units for properties.

Sterling Management, LLC

Sterling Office and Industrial Trust operates under the direction of the Board of Trustees, the members of which are accountable to the Trust and its shareholders as fiduciaries. However, the Trust has no paid employees and therefore retains a management company to manage the Trust’s, and Sterling Office and Industrial Properties’ day-to-day affairs. Since inception, the Trust has relied upon Sterling Management, LLC as its external management company. Sterling Management, LLC has proudly served REITs for more than 15 years, its CEO, President, CIO and CFO serve concurrently as the Trust’s executive officers.

OUR VALUES

Respect

We develop and maintain relationships based on trust, cooperation, collaboration, and open communication with investors, state and federal agencies, brokers and our many service providers.

Excellence

We achieve excellence by fostering a work environment that supports learning, innovation, and change. We strive for continuous improvement, recognizing these components as essential to achieving excellence.

Integrity

Integrity is the foundation of our credibility. We set high standards for our work and follow the highest ethical and professional standards.

Transparency

To best serve our investors, we provide accurate, complete, and traditional information. We produce reports that are objective, useful, clear, and candid.

Stewardship

We are continually committed to our investors. We work to build stronger trust for future generations, acting at all times with an owner’s mentality.